CUSTOMER SUPPORT PROGRAMME

TO OUR VALUED CUSTOMERS

We remain committed to providing you, our valued customers, with the best possible service during this outbreak of the Corona Virus (COVID-19). We recognize the potential impact that this situation will have on your ability to service your credit facilities in the immediate period ahead.

Accordingly, pursuant to the agreements reached among member banks of the Eastern Caribbean Currency Union, we have crafted a Customer Support Programme for those credit/loan customers who are impacted by the COVID-19 Pandemic.

Consistent with the aforementioned agreement, our Customer Support Programme will provide a loan repayment moratorium for an initial period of up to six (6) months commencing March 2020, for eligible personal and business customers. Based on our initial assessment, the eligible customers will comprise of both employees and business owners under the following categories:

Tourism Sector

- Hotels and Guest Houses

- Airbnb Providers

- Tour/Taxi Operators

- Other Ancillary Service Providers

Cruise Line Sector

The Entertainment Sector

- Restaurants & Bars

- Night Club Operators

Medical School Accommodation and other Apartments

Airline Sector

Agriculture and Fisheries Sector including Traffickers

Churches

Health Care Providers

Other Care Service Providers (personal beautification)

Loans to persons in the Diaspora, who either lost jobs or are on a reduced incom

Transportation Sector – Minibus Operators/Taxi Operators/Ferry Operators

Vendors & Micro Retailers

The categories listed above are not exhaustive and will be amended as a clearer picture of the impact emerges. In the meantime, we have conducted a review of our portfolio and have identified a number of customers who meet the eligibility criteria outlined above. We will, therefore, be contacting these customers directly over the course of the next few weeks to arrange for their participation in the Customer Support Programme.

Those customers whose employment or businesses are not immediately impacted will continue to pay their loans as normal. We will, however, consider, on a case by case basis, those customers whose disposable income would have been indirectly impacted mainly from job losses within the immediate family and or extended family.

Please note that, as a result of your participation in the Customer Support Programme, the maturity date of the loan will be extended by a minimum of six (6) months to facilitate the repayment of the deferred principal and interest payments arising from the moratorium.

Please also note that in the majority of cases (across all financial institutions offering similar programs), the loan will be restructured at the end of the moratorium to incorporate the unpaid interest.

The Customer Support Programme will not be available to customers whose loans are already over ninety (90) days in arrears and classified as non-performing. Such loans will continue to be managed as normal.

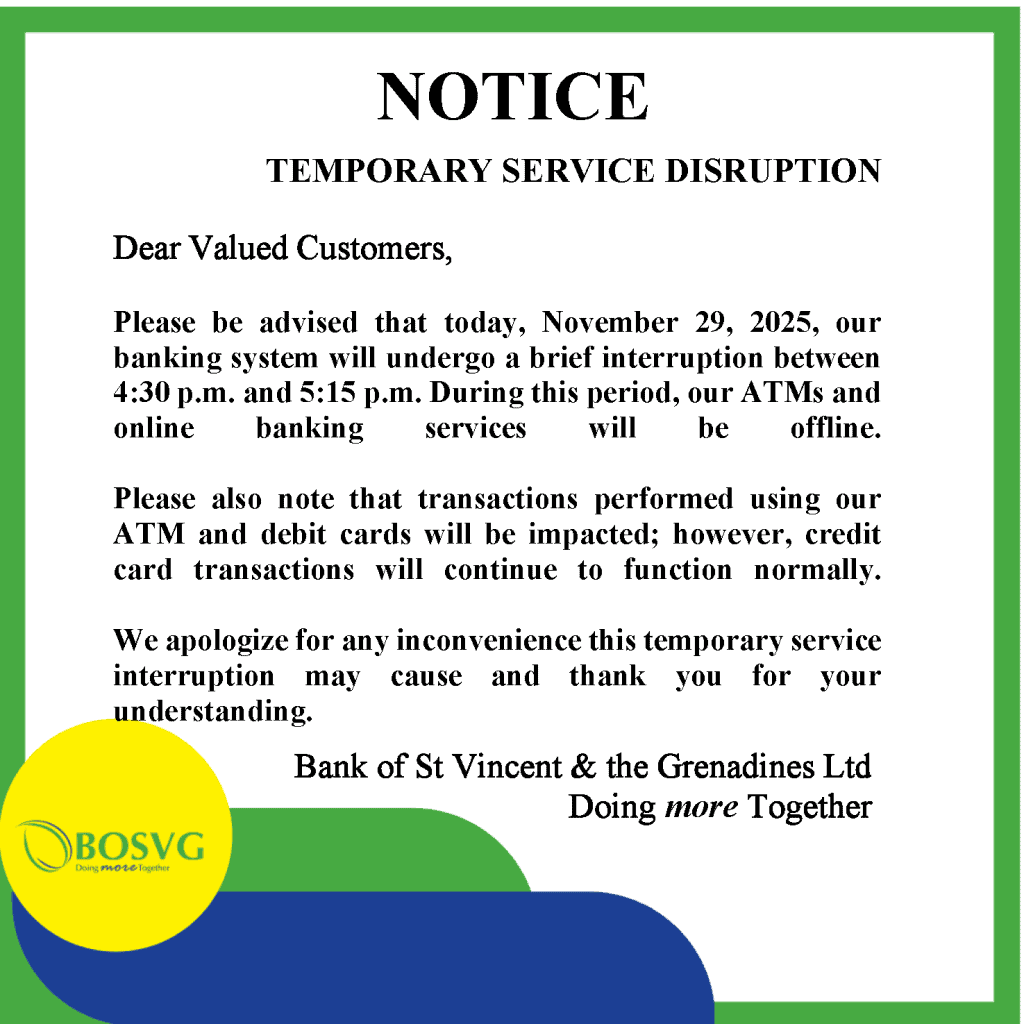

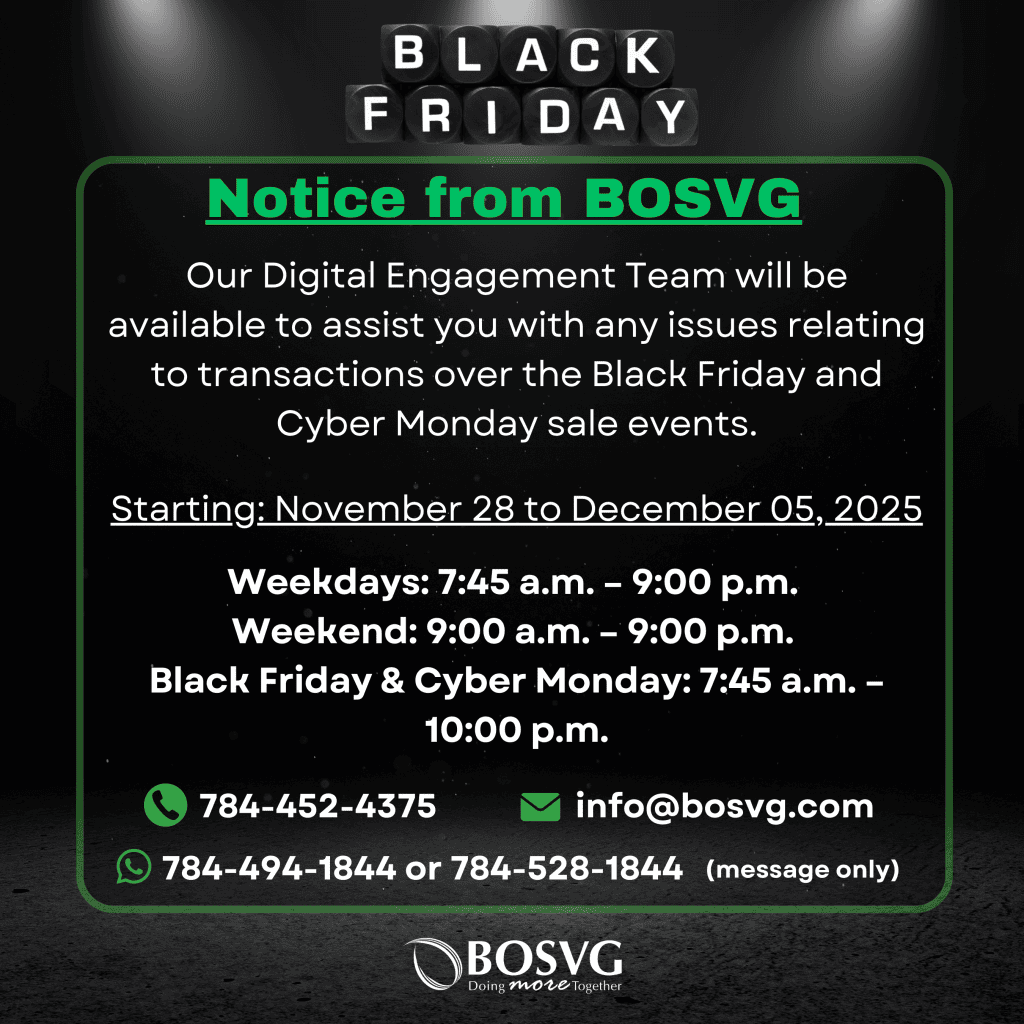

Customers wishing to contact the Bank for further details and or clarifications can do so by:

Email: supportprogramme@bosvg.com Telephone: 1 784 452 4325 / 1 784 452 4128 during working hours (8am – 4:30pm)

With very best wishes from all of us at the Bank of St Vincent and the Grenadines Ltd

Doing more Together.